With the fresh wave of high school graduates stepping into the threshold of adulthood, life may seem refreshingly uncomplicated, free from the constraints of textbooks and late-night study sessions. Yet, within this apparent simplicity, they stand at a crossroads, where they are confronted with a blend of excitement and uncertainty about the road ahead.

The excitement builds for university enrollment, with some already delving into their studies while others eagerly await their turn later in the year. Amidst this transition, one thing becomes evident: the importance of financial literacy. Many are experiencing money management for the first time, but a significant number of students feel unprepared for this responsibility. Transitioning to adulthood isn’t just about gaining freedom; it’s also about learning how to manage money wisely.

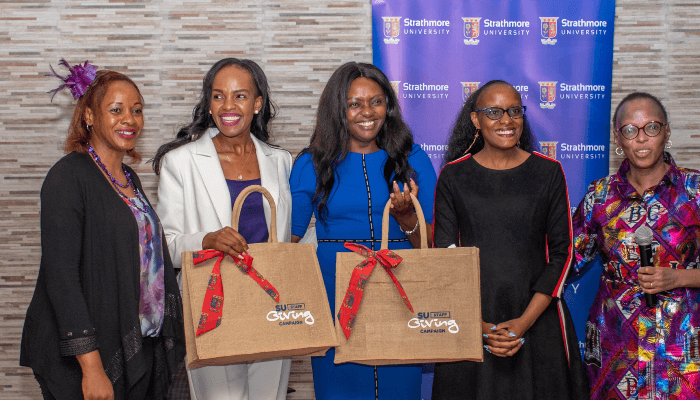

Last week, Strathmore Institute of Mathematical Sciences (SIMS) celebrated the graduation of its first cohort of the Financial Literacy Programme. The program equipped high school students with essential skills in budgeting, saving, and investing, laying a solid foundation for their financial futures.

Key takeaways from the programme:

- Budget, Budget, Budget!

This involves tracking your spending; being aware of where your money goes, and when. Budgeting helps you steer clear of overspending on unnecessary items like takeout or daily coffees. While it’s important to enjoy life, adhering to a reasonable budget prevents wasteful spending.

- Keep your spending impulses in check

Managing your spending impulses is essential for financial stability, especially for college freshmen who often lack clear budgets. Overspending can lead to exceeding intended expenses and causing financial stress. It’s vital to stay within your means, even when experiencing FOMO or peer pressure. You don’t need to match your friends’ spending to fit in; resist the notion that big spenders are the norm. Control your spending habits to avoid unnecessary expenses. Even with financial support from family, learning to live within a budget is essential. Prioritizing financial well-being now will yield long-term benefits.

- Setting a financial goal

Whatever your plans may be, whether it’s academics or extracurriculars during your time on campus, it’s crucial to set realistic financial goals. These goals should align with your current situation to support your aspirations.

- Start by setting short-term goals, achievable within a year. This could include daily expenses such as stationery, living expenses, or investing in necessary items like a new computer or furniture.

- Medium-term goals span one to five years. Maybe you’re dreaming of a big trip or planning to advance your education in a graduate school abroad, or building an emergency fund to provide financial security in unforeseen circumstances.

- Long-term goals, extending beyond five years, are essential too. Whether it’s diligently saving for retirement or gradually accumulating a significant down payment for your future home, these goals demand strategic planning and consistent commitment to financial stability.

Developing a solid financial plan early on fosters responsible money management habits. It teaches budgeting skills and the importance of saving. Additionally, it provides a safety net, empowering students to navigate unexpected financial challenges without accumulating debt.

- Budget, Budget, Budget!

This involves tracking your spending; being aware of where your money goes, and when. Budgeting helps you steer clear of overspending on unnecessary items like takeout or daily coffees. While it’s important to enjoy life, adhering to a reasonable budget prevents wasteful spending.

- Start saving

It is important to save, although setting money aside can feel challenging, especially on a limited budget. No matter how small the contribution – whether it’s just Ksh. 20 or Ksh. 1000, saving now can make a significant difference later. By starting to save now, even with modest amounts, you can make a considerable impact in the future. This practice lays the foundation for financial security, providing a safety net during unexpected challenges.

Consider joining a Sacco or using a savings app such as Mshwari etc. to build a safety net for emergencies while in university.

- Learn about taxes

As students, you’re continuously being prepared to enter the workforce and it’s important to understand taxes, especially since job opportunities will soon come knocking. Ever heard of Pay-As-You-Earn (PAYE) taxes? They’re the ones deducted from employees’ salaries based on what they earn. And did you know that you’ll need to file your tax returns annually with the Kenya Revenue Authority (KRA) by June 30th?

It might sound overwhelming, but taking the time to learn about taxes now will pay off in the long run. Plus, staying updated on changes in tax laws is crucial for managing your finances effectively.

Are you a recent high school graduate? Join this programme and gain essential skills in budgeting, saving, and investing for a prosperous future.

Article written by: Jemmy M. Kamau

What’s your story? We’d like to hear it. Contact us via communications@strathmore.edu

ALSO CHECK OUT

See more news-

Stratizens Triumph at Olympia Invitational Debate Tournament* 11,Apr,2024

The Strathmore Debate Society clinched monumental victories at the prestigious Olympia Invitational,

-

Bridging gender gap in healthcare* 09,Apr,2024

In Kenya, women remain underrepresented in senior positions across many sectors, including

-

Financial Literacy – What students need to know* 09,Apr,2024

With the fresh wave of high school graduates stepping into the threshold

-

THE TIGONI EXPERIENCE* 05,Apr,2024

It all started with receiving an invitation to the 2024 Tigoni Leadership

-

Even Wars have Laws: A Simulation of War* 05,Apr,2024

“Even Wars Have Laws,” Mr. Allan Mukuki, lecturer at the Law School,

-

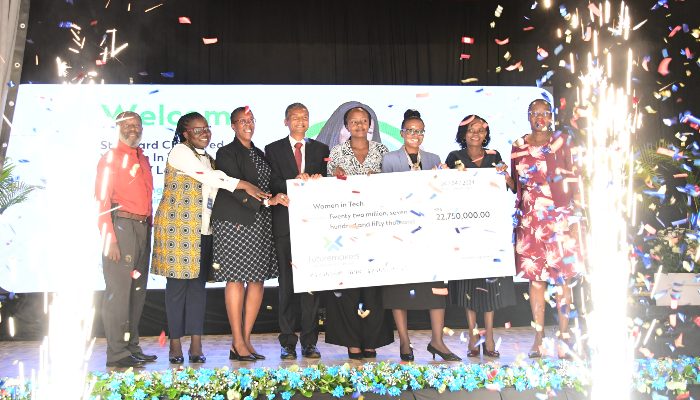

Cohort 7 of Women in Tech Launched* 04,Apr,2024

@iBizAfrica – Strathmore University in partnership with Standard Chartered Bank has launched

-

Strengthening Bonds: Strathmore Alumni Reunion in Uganda* 04,Apr,2024

On the evening of March 1, 2024, a significant gathering unfolded at

-

Nurturing Lifelong Connections: A Journey Beyond Graduation* 04,Apr,2024

Friendships forged during school life burn bright long after the caps are

-

Future proof: The School of Engineering and Computer Sciences commemorates World Engineering Day* 12,Mar,2024

The air crackles with innovative energy on Strathmore’s campus today. Engineers of

-

When your deep gladness and the world’s deep hunger meet* 11,Mar,2024

Sitting in a room among women adorned with talent and resilience, radiating